Financial planning for freelancers in 2025 involves strategic budgeting, tax optimization, retirement savings, and risk management to maximize income and minimize tax liabilities, ensuring financial stability and long-term growth.

As a freelancer, managing your finances effectively is crucial for long-term success. Financial planning for freelancers: maximizing your income and minimizing your taxes in 2025 requires a proactive and strategic approach. Let’s dive in to help you navigate the complexities and optimize your financial well-being.

Understanding the Unique Financial Landscape for Freelancers

Freelancing offers flexibility and autonomy, but it also comes with unique financial challenges. Unlike traditional employees, freelancers are responsible for managing their own taxes, benefits, and retirement savings. Understanding this landscape is the first step toward effective financial planning.

Cash Flow Management

Irregular income is a common challenge for freelancers. Effective cash flow management is essential to ensure you can cover your expenses and save for the future.

- Track your income and expenses meticulously.

- Create a budget that accounts for fluctuations in income.

- Build an emergency fund to cover unexpected expenses.

Self-Employment Taxes

Freelancers are subject to self-employment taxes, which include Social Security and Medicare taxes. Planning for these taxes is crucial to avoid surprises at tax time.

Investing in Your Business

As a freelancer, you are your business. Investing in your skills, equipment, and marketing efforts can help you grow your income and expand your client base.

Effective financial planning for freelancers involves understanding the unique challenges and opportunities that come with self-employment. By focusing on cash flow management, tax planning, and strategic investments, you can build a solid financial foundation for your freelance career.

Budgeting Strategies for Freelancers in 2025

Budgeting is the cornerstone of effective financial planning. For freelancers, creating a budget that adapts to fluctuating income is essential. Here are some strategies to help you manage your finances effectively in 2025.

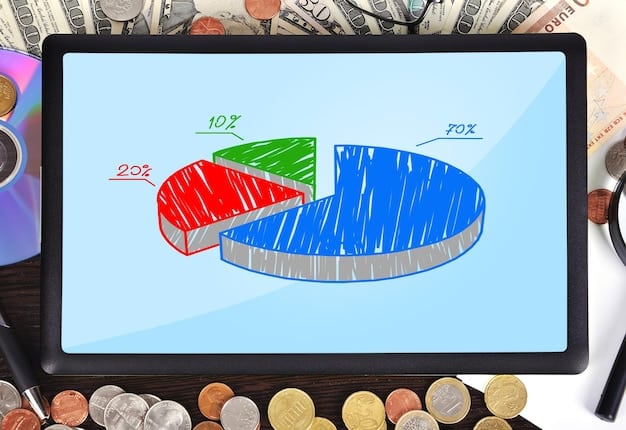

The 50/30/20 Rule

The 50/30/20 rule is a simple budgeting framework that can help freelancers allocate their income effectively.

- 50% of your income should go toward needs, such as housing, food, and transportation.

- 30% of your income should go toward wants, such as entertainment and dining out.

- 20% of your income should go toward savings and debt repayment.

Zero-Based Budgeting

Zero-based budgeting is a budgeting method where you allocate every dollar of your income to a specific purpose. This ensures that your income is used intentionally and efficiently.

Tracking Your Expenses

Tracking your expenses is crucial for understanding where your money is going. Use budgeting apps or spreadsheets to monitor your spending and identify areas where you can cut back.

Effective budgeting strategies for freelancers involve creating a flexible budget, tracking expenses, and allocating income intentionally. By using tools and techniques like the 50/30/20 rule and zero-based budgeting, freelancers can gain control of their finances and save for the future.

Tax Planning: Minimizing Your Tax Burden in 2025

Tax planning is a critical aspect of financial planning for freelancers. Understanding the tax laws and taking advantage of deductions and credits can significantly reduce your tax burden in 2025.

Deductible Expenses

Freelancers can deduct many business-related expenses, including home office expenses, equipment costs, and travel expenses. Keeping accurate records of these expenses is essential for maximizing your deductions.

Estimated Taxes

Freelancers are required to pay estimated taxes quarterly to avoid penalties. Calculating your estimated taxes accurately and paying them on time is crucial for staying compliant with tax laws.

Retirement Contributions

Contributing to a retirement account can not only help you save for the future but also reduce your taxable income. Consider opening a SEP IRA or Solo 401(k) to take advantage of these tax benefits.

Effective tax planning for freelancers involves understanding deductible expenses, paying estimated taxes, and contributing to retirement accounts. By staying informed and organized, freelancers can minimize their tax burden and maximize their financial well-being.

Retirement Savings Strategies for Self-Employed Individuals

Retirement savings is an essential component of financial planning, especially for self-employed individuals who don’t have access to employer-sponsored retirement plans. As a freelancer, it’s crucial to take proactive steps to secure your financial future.

SEP IRA

A Simplified Employee Pension (SEP) IRA is a popular retirement savings option for freelancers. It allows you to contribute up to 20% of your net self-employment income, with contributions being tax-deductible.

Solo 401(k)

A Solo 401(k) is another retirement savings option for self-employed individuals. It offers higher contribution limits compared to a SEP IRA and can be either traditional or Roth.

Roth IRA

A Roth IRA is a retirement account where contributions are made with after-tax dollars, but earnings and withdrawals are tax-free. This can be a good option if you expect to be in a higher tax bracket in retirement.

Effective retirement savings strategies for self-employed individuals include exploring options such as SEP IRAs, Solo 401(k)s, and Roth IRAs. By starting early and contributing consistently, freelancers can build a substantial retirement nest egg and secure their financial future.

Managing Debt and Credit as a Freelancer

Managing debt and credit is an important aspect of financial planning for freelancers. Debt can be a significant burden, and managing your credit wisely can improve your financial stability and access to future financing.

Debt Management Strategies

Freelancers should prioritize managing debt effectively to avoid financial strain. Strategies include creating a debt repayment plan, consolidating debt, and avoiding high-interest debt.

- Prioritize high-interest debt, such as credit card debt.

- Consider debt consolidation to simplify repayment.

- Avoid taking on new debt unless necessary.

Building and Maintaining Good Credit

A good credit score is essential for accessing loans, credit cards, and other financial products. Freelancers should take steps to build and maintain good credit by paying bills on time, keeping credit utilization low, and monitoring their credit report.

Emergency Fund

An emergency fund is a crucial safety net for freelancers. It can help cover unexpected expenses and reduce the need to rely on credit or debt.

Effective debt and credit management for freelancers involves prioritizing debt repayment, building and maintaining good credit, and creating an emergency fund. By taking these steps, freelancers can improve their financial stability and minimize the risk of financial hardship.

Insurance and Risk Management for Freelancers

Insurance and risk management are key components of a solid financial plan for freelancers. Protecting your income and mitigating potential risks can provide peace of mind and financial security.

Health Insurance

Freelancers are responsible for obtaining their own health insurance. Options include individual health insurance plans, COBRA coverage, and health savings accounts (HSAs).

Disability Insurance

Disability insurance can provide income replacement if you become unable to work due to illness or injury. This is particularly important for freelancers who rely on their ability to work to earn income.

Liability Insurance

Liability insurance can protect you from financial losses if you are sued for negligence or other professional errors. This is especially important for freelancers who provide professional services.

Effective insurance and risk management for freelancers involves obtaining adequate health insurance, disability insurance, and liability insurance. By protecting your income and mitigating potential risks, freelancers can create a more secure financial future.

| Key Aspect | Brief Description |

|---|---|

| 💰 Budgeting | Create a flexible budget to manage irregular income effectively. |

| 🧾 Tax Planning | Understand deductible expenses and pay estimated taxes quarterly. |

| 🏦 Retirement Savings | Explore SEP IRAs or Solo 401(k)s for retirement savings. |

| 🛡️ Risk Management | Secure health, disability, and liability insurance. |

FAQ

Freelancers often deal with irregular income, self-employment taxes, and the responsibility of managing their own benefits and retirement savings, making financial planning crucial.

Using the 50/30/20 rule, zero-based budgeting, and carefully tracking expenses are effective strategies. Regularly reviewing and adjusting your budget is also important.

Common deductions include home office expenses, business equipment costs, travel expenses, and contributions to retirement accounts. Keeping detailed records is key to claiming these deductions.

SEP IRAs, Solo 401(k)s, and Roth IRAs are popular choices. Each offers different contribution limits and tax advantages, so choose one that aligns with your financial goals.

Health, disability, and liability insurance protect freelancers from potential financial ruin due to illness, injury, or lawsuits. Ensuring you have adequate coverage is essential.

Conclusion

In conclusion, financial planning for freelancers: maximizing your income and minimizing your taxes in 2025 requires diligent budgeting, strategic tax planning, proactive retirement savings, and comprehensive risk management. By implementing these strategies, freelancers can build financial stability, achieve their long-term goals, and thrive in their careers.

New Tax Law Changes in 2025: How the Capital Gains Tax Increase Impacts You

New Tax Law Changes in 2025: How the Capital Gains Tax Increase Impacts You  Navigating the 2025 Tax Law: A 10% Capital Gains Tax Increase

Navigating the 2025 Tax Law: A 10% Capital Gains Tax Increase  LowRiskInvesting: Strategies for Smart Investors

LowRiskInvesting: Strategies for Smart Investors