Understanding the Risks and Rewards of Investing in Real Estate in 2025: A Comprehensive Analysis requires careful consideration of market trends, economic forecasts, and individual financial goals to navigate potential profits and challenges effectively.

Investing in real estate can be a lucrative venture, but it’s crucial to understand the landscape, especially when looking ahead to 2025. This article provides a comprehensive analysis of understanding the risks and rewards of investing in real estate in 2025: a comprehensive analysis, giving you the knowledge to make informed decisions.

Real Estate Investment in 2025: An Overview

Real estate investment in 2025 could evolve, as different factors will influence its direction and provide both opportunities and potential obstacles. A comprehensive approach is essential for investors navigating the market.

This article delves into the various aspects of next years real estate market to provide an in depth look and guide you in making smart decisions in 2025.

Economic Factors Influencing Real Estate

Economic stability plays a significant role in the real estate market. Keep a close eye on these factors:

- Interest rates affect mortgage affordability and overall demand.

- GDP growth typically correlates with increased property values.

- Inflation can impact construction costs and rental rates.

Technological Impacts on Real Estate

Technology is transforming the way properties are bought, sold, and managed. Here are some innovations to watch:

- PropTech platforms streamline property management and investment analysis.

- Virtual reality tours enhance the buying experience.

- Smart home technology increases property appeal and value.

The real estate market of 2025 presents a mix of economic and technological factors that investors must understand to make informed decisions.

Assessing Potential Risks in 2025

Although investing in real estate may be profitable, you should be aware of potential risks, which are crucial for preserving capital and maximizing returns.

The following segments will elaborate on some risk factors that will help you navigate investing in 2025.

Market Volatility

Real estate markets can fluctuate due to various factors. Here’s how to mitigate risk:

- Diversify your portfolio across different property types and locations.

- Conduct thorough market research to identify stable areas.

- Stay informed about local economic conditions and demographic shifts.

Regulatory Changes

Changes in regulations can significantly impact returns. Consider these points:

- Understand zoning laws and building codes in your target areas.

- Monitor changes in tax policies that affect real estate investments.

- Stay compliant with environmental regulations to avoid costly penalties.

Financial Risks

Managing finances effectively is crucial for real estate investments. Consider these strategies:

- Maintain a healthy debt-to-equity ratio to avoid over-leveraging.

- Secure adequate insurance coverage to protect against property damage.

- Plan for unexpected expenses such as repairs and maintenance.

To navigate the real estate market in 2025 to preserve your capital and maximize returns, you must assess and address the risks related to market volatility, regulatory changes, and financial management. This method maximizes the likelihood of a successful investment.

Identifying Lucrative Opportunities

To become successful when investing in real estate in 2025, one must consider the lucrative opportunities and developments in the current market.

The following paragraphs will discuss prime opportunities to help you make smart and effective decisions.

Emerging Markets

Investing in emerging markets can yield high returns. Some things to look for are:

- Areas with strong job growth and increasing populations.

- Regions undergoing significant infrastructure development.

- Locations with favorable government policies for real estate investment.

Property Types

Different property types offer varying levels of risk and reward. A quick breakdown:

- Residential properties provide steady rental income and potential appreciation.

- Commercial properties offer higher rental yields but may have longer vacancy periods.

- Industrial properties can be lucrative due to the growing demand for logistics and warehousing.

Seeking out underutilized property types or locations that are experiencing economic growth would be the key to finding lucrative opportunities. Diversifying your investments and performing research are also vital.

Strategies for Maximizing Returns

Employing effective tactics and well-researched actions are essential to maximizing returns on the real estate properties you purchase.

Here are a few ways to maximize your returns in 2025.

Value-Added Improvements

Enhancing property value through renovations and upgrades will help you greatly. Here’s how:

- Renovate kitchens and bathrooms to attract quality tenants.

- Upgrade energy-efficient appliances to reduce utility costs.

- Add amenities such as gyms or co-working spaces to increase appeal.

Effective Property Management

Strong property management can significantly impact your bottom line. Key elements to consider:

- Screen tenants thoroughly to minimize vacancies and damages.

- Maintain properties regularly to prevent costly repairs.

- Utilize property management software to streamline operations.

To maximize profits in 2025, it is essential to implement initiatives to increase property value and efficiently manage properties. Proactive management and calculated improvements lead to higher gains.

Navigating Financing Options

Understanding the available financing choices is crucial for managing expenses and maximizing the return from your investments.

The details of financing options are broken down below.

Traditional Mortgages

These offer stability and predictable payments. Some key points:

- Fixed-rate mortgages provide interest payments that are consistent over the life of the loan.

- Adjustable-rate mortgages (ARMs) offer lower initial rates but can change over time.

- Consider the terms and conditions, including prepayment penalties and loan fees.

Alternative Financing

Consider these options for more flexibility. Some popular alternative financing options are:

- Private lenders offer personalized terms and can be more flexible than traditional banks.

- Real estate investment trusts (REITs) allow you to invest in a portfolio of properties without direct ownership.

- Crowdfunding platforms provide access to capital from multiple investors.

Understanding the details of each financing option and how they coincide with your investment plan is important. Alternative financing, along with conventional mortgages, can present advantages and flexibility when managing expenses and increasing rewards.

Expert Insights and Predictions for 2025

Looking towards 2025, you must take expert knowledge and sector projections into consideration to maintain competitiveness and effectively navigate investing in real estate.

Here are some insights and predictions for 2025.

Industry Trends

Stay ahead by watching these trends closely:

- Increased demand for sustainable and eco-friendly properties.

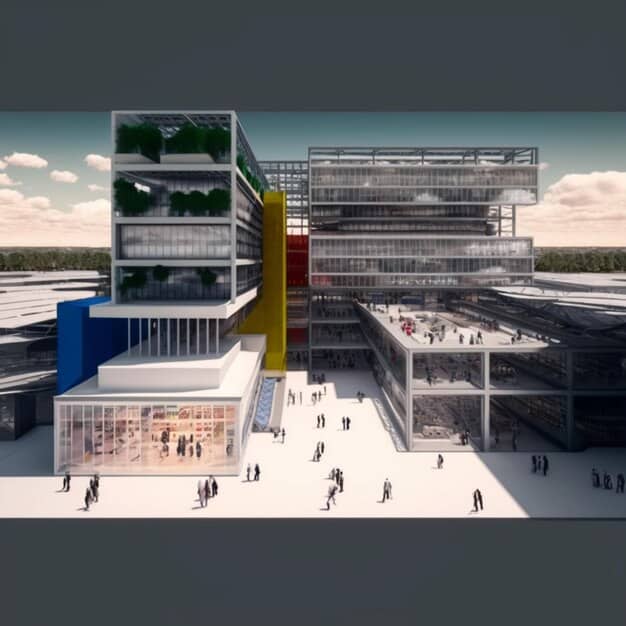

- Growing popularity of mixed-use developments that combine residential, commercial, and recreational spaces.

- Focus on community-centric designs that foster social interaction.

Expert Forecasts

Staying up-to-date with the professionals is essential for being prepared. Consider these insights:

- Analysts predict continued growth in suburban and exurban areas.

- Experts suggest that rental rates will remain stable with moderate increases in high-demand markets.

- Economists advise monitoring interest rate fluctuations and their impact on property values.

In order to properly prepare for investment in real estate in 2025, you must stay informed about sector trends and expert views. Keeping an eye on ecological buildings and paying attention to expert views will help you make well-informed decisions.

| Key Point | Brief Description |

|---|---|

| 📈 Market Analysis | Assess economic factors and emerging markets. |

| 🛡️ Risk Mitigation | Diversify investments and monitor regulatory changes. |

| 💰 Financing Options | Explore traditional and alternative financing methods. |

| 💡 Expert Insights | Follow industry trends and expert forecasts. |

FAQ

▼

Interest rates, GDP growth, and inflation rates are crucial economic indicators. Monitoring these factors will help assess the overall stability and potential growth of the real estate market.

▼

Diversifying your investment portfolio across different property types and locations can reduce risk. Thorough market research and staying informed about economic conditions may also help.

▼

Residential, commercial, and industrial properties all offer unique opportunities in 2025. The emerging markets, such as suburban are growing and should be looked into.

▼

PropTech platforms can streamline investment analysis, and virtual reality tours can enhance buying experience. Smart home tech can be used to increase property value.

▼

Traditional mortgages, private lenders, REITs, and crowdfunding platforms offer varied financing options. Consider your financial goals to find the most suitable method for you.

Conclusion

Finally, understanding the risks and rewards of investing in real estate in 2025: a comprehensive analysis means being informed about real estate trends, being adaptable, and taking a smart investing strategy. You can confidently handle opportunities in this lively market in 2025 if you stay current on the latest market conditions, know all of the choices available to you, and get advice from professionals.

New Tax Law Changes in 2025: How the Capital Gains Tax Increase Impacts You

New Tax Law Changes in 2025: How the Capital Gains Tax Increase Impacts You  Navigating the 2025 Tax Law: A 10% Capital Gains Tax Increase

Navigating the 2025 Tax Law: A 10% Capital Gains Tax Increase  LowRiskInvesting: Strategies for Smart Investors

LowRiskInvesting: Strategies for Smart Investors