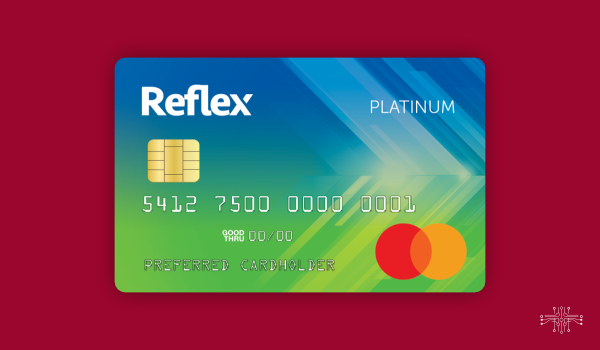

When rebuilding credit, the most valuable feature is not rewards or luxury perks, but access to a product that is realistic and manageable. The Reflex Platinum Credit Card is positioned as a functional option for individuals who want to move forward after financial setbacks. It is designed to support everyday spending while encouraging responsible credit behavior over time.

Instead of relying on complex benefits, this card emphasizes usability and consistency. With digital account access, broad acceptance and regular reporting to credit bureaus, it helps users focus on rebuilding trust with lenders step by step. For those seeking a clear path back into the credit system, the Reflex Platinum Credit Card offers a straightforward approach.

How the Reflex Platinum Card Fits Into a Credit Recovery Plan

An Entry Point for Those Restarting Their Credit Journey

The card is structured to be accessible for individuals who may not qualify for traditional credit cards, offering a realistic option for restarting credit activity.

Unsecured Access Without Tying Up Cash

Applicants are not required to provide a security deposit, allowing them to access credit without committing upfront funds.

Ongoing Credit History Contribution

Each billing cycle, account activity is reported to major credit bureaus, helping cardholders establish a positive payment record.

Opportunity for Gradual Limit Adjustments

Consistent on-time payments may open the door to higher credit limits over time, providing increased flexibility.

Everyday Use Across the Mastercard Network

The card works wherever Mastercard is accepted, including online retailers, service providers and physical stores.

Monitoring Designed to Reduce Risk

Transaction monitoring tools help detect irregular activity and protect users from unauthorized charges.

Modern Payment Options for Convenience

Contactless payments and compatibility with digital wallets make transactions faster and more efficient.

Full Visibility Through Digital Account Tools

Balances, statements, transactions and payments can be managed through a secure online platform.

Multiple Ways to Stay Current on Payments

Cardholders can choose from various payment methods, making it easier to meet monthly obligations.

Encourages Consistency Over Short-Term Spending

The card’s design supports controlled use and regular payments, both essential for long-term credit improvement.

Who May Benefit From the Reflex Platinum Credit Card

This card may be a suitable option for individuals who:

- Are actively working to improve their credit standing

- Want an unsecured card without a deposit requirement

- Prefer managing finances digitally

- Need a basic credit card for routine expenses

- Value consistency and transparency

- Want payment activity reflected in credit reports

General Conditions for Application

Applicants are typically expected to:

- Meet the minimum age requirement to apply

- Reside within the United States

- Have a valid Social Security number

- Provide complete and accurate personal details

- Show the ability to handle monthly payments

- Meet the issuer’s internal review standards

Approval decisions are based on a combination of financial factors rather than credit score alone.

Step-by-Step: How to Apply for the Reflex Platinum Credit Card

1. Start by visiting the official Reflex Platinum Credit Card platform or a trusted partner page to review current fees, rates, and terms.

2. Once you understand the conditions, proceed to the digital application form—no in-person visits are required.

3. Fill out the secure form with accurate personal and contact details.

4. In some cases, you may be asked to share income or employment details to support the application review.

5. After completing all required fields, submit the application for evaluation.

6. Applications are typically reviewed quickly, and many applicants receive a response in a short time.

7. If approved, your physical Reflex Platinum Credit Card will be sent to your address.

8. Once activated, the card is ready for approved purchases.

9. Consistent, timely payments help keep your account in good standing and support long-term credit improvement.

What People Often Want to Know About the Reflex Platinum Credit Card

Is the Reflex Platinum Card backed by a security deposit?

No. This card provides unsecured credit access and does not require upfront collateral.

Can using the card help improve credit standing?

Yes. Account activity is shared with major credit bureaus, allowing responsible use to support credit growth.

Are there ongoing costs to keep the card?

An annual fee typically applies. Applicants should always review the most current terms before proceeding.

Is it possible to receive a higher spending limit later?

Yes. Credit limit adjustments may be considered after consistent, positive payment behavior.

Where is the card accepted?

The card works anywhere the Mastercard network is supported.

Do I need to place a deposit to open the account?

No deposit is required to activate the card.

Is online account access available?

Yes. Users can manage their account digitally through secure online tools.

Does the card allow contactless payments?

Yes. Tap-to-pay functionality is included for compatible terminals.

How fast is the approval process?

Many applicants receive a decision within a short period of time.

What are the consequences of missing a payment?

Late payments may result in fees and could negatively affect your credit profile.

Can the card be used for online shopping?

Yes. It supports both online transactions and in-store purchases.

Is customer service available if I need help?

Yes. Support is available to assist with account-related questions.

Grow Credit Mastercard Review <p class='sec-title' style='line-height: normal; font-weight: normal;font-size: 16px !important; text-align: left;margin-top: 8px;margin-bottom: 0px !important;'>The Grow Credit Mastercard helps build credit by turning monthly subscriptions into reported payment activity.</p>

Grow Credit Mastercard Review <p class='sec-title' style='line-height: normal; font-weight: normal;font-size: 16px !important; text-align: left;margin-top: 8px;margin-bottom: 0px !important;'>The Grow Credit Mastercard helps build credit by turning monthly subscriptions into reported payment activity.</p>  Wells Fargo Reflect Card Review <p class='sec-title' style='line-height: normal; font-weight: normal;font-size: 16px !important; text-align: left;margin-top: 8px;margin-bottom: 0px !important;'>The Wells Fargo Reflect Card offers an extended 0% APR period, no annual fee and flexible repayment options.</p>

Wells Fargo Reflect Card Review <p class='sec-title' style='line-height: normal; font-weight: normal;font-size: 16px !important; text-align: left;margin-top: 8px;margin-bottom: 0px !important;'>The Wells Fargo Reflect Card offers an extended 0% APR period, no annual fee and flexible repayment options.</p>  BJ’s One Plus Mastercard Review <p class='sec-title' style='line-height: normal; font-weight: normal;font-size: 16px !important; text-align: left;margin-top: 8px;margin-bottom: 0px !important;'>The BJ’s One Mastercard rewards bulk shopping, fuel purchases and everyday spending, offering a practical cashback solution for BJ’s members.</p>

BJ’s One Plus Mastercard Review <p class='sec-title' style='line-height: normal; font-weight: normal;font-size: 16px !important; text-align: left;margin-top: 8px;margin-bottom: 0px !important;'>The BJ’s One Mastercard rewards bulk shopping, fuel purchases and everyday spending, offering a practical cashback solution for BJ’s members.</p>